Latest Home loan and you may Re-finance Pricing into the Washington

Rebecca is actually a freelance contributor so you’re able to Newsweek’s private money group. An authorized education loan counselor, she’s created commonly with the student loan personal debt and better training. Rebecca comes with secure many different other individual fund information, also unsecured loans, the brand new housing marketplace and you will credit. The woman is dedicated to providing someone understand their choices making told decisions about their currency.

Jenni is actually an individual financing publisher and you will copywriter. Their favourite subject areas is paying, mortgages, real estate, budgeting and you can entrepreneurship. She and hosts brand new Mama’s Money Map podcast, which loans for people with credit score 550 will help stand-at-home mom earn significantly more, save money and by taking people.

When she actually is not creating or editing, discover Jenni getting their family to have nature hikes along the Wasatch Front side, stitching with her sisters or conquering anyone at the Scrabble.

Rates of interest features basically been broadening for the past long-time, therefore the current financial prices inside the Arizona are not any exemption. According to study away from Redfin, 30-12 months repaired financial pricing from inside the Arizona average 6.667% Annual percentage rate, when you find yourself 31-season repaired refinance cost during the Arizona mediocre eight.442% Apr.

Understanding the rates when you look at the Arizona helps you evaluate your choices for lenders and discover the best financial program to suit your funds. As well as old-fashioned mortgages, you can imagine a federal government-backed financing, for example an FHA or Va loan, otherwise discuss software to possess very first-big date homeowners.

This informative guide goes over all of these programs to own prospective homebuyers into the the Evergreen Condition so you can pick the best money alternative for your house buy.

The scientific studies are made to present an extensive insights regarding private loans merchandise you to work best with your circumstances. To help you throughout the decision-and also make processes, our expert contributors contrast prominent choice and you may prospective pain circumstances, eg cost, accessibility, and you may trustworthiness.

Latest Washington Financial Prices

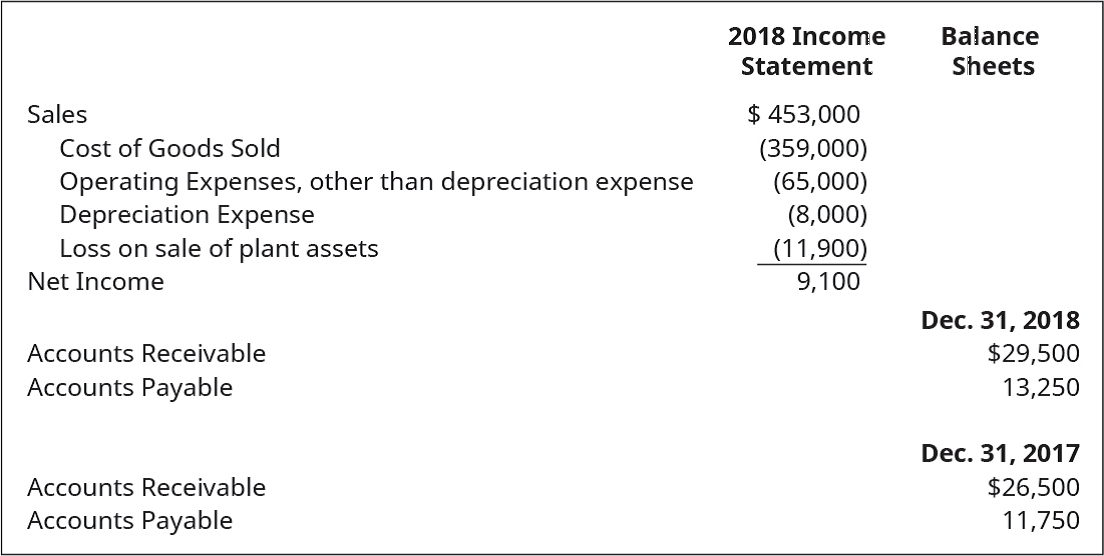

Current financial costs in Washington average doing six.6% to have fifteen-12 months money and eight.4% to own 30-seasons finance. This new rates regarding desk lower than come from Redfin and its own financial cost mate, icanbuy, and are also predicated on a good $320,000 loan.

Brand new averages and suppose a great 20% down-payment and you can a credit history out of 740 or higher. The brand new desk shows both rates of interest and you can yearly fee costs (APRs), which are a bit different steps of the credit costs.

Interest levels consider appeal accrual alone, whereas Annual percentage rate is actually an even more inclusive identity which will take charges, including control otherwise file preparing charge, into consideration. As you care able to see, financial prices vary dependent on several factors, such as the amount of the new cost title, particular interest rate (repaired or changeable) and type out-of financial, should it be a traditional financial, FHA otherwise Va loan.

Refinance loan Prices when you look at the Washington

Re-finance prices within the Arizona try quite more than the new pricing to own house buy funds-and you will considerably more than the two% to three% lows in the COVID-19 pandemic. For individuals who already have a decreased speed, refinancing mortgage will most likely not force you to discounts. Having ascending home values, whether or not, you may have far more security so you can faucet on your own Washington home compared to many years previous.

Vault’s View: Washington Home loan Costs Trend into the 2024

Its difficult to anticipate the future of financial prices, nonetheless it appears they are going to remain notably greater than they were within the pandemic throughout the year. The fresh Federal Reserve hiked prices many times prior to now few out-of many years as a way to curb rising cost of living.

The fresh new Provided is apparently holding costs regular for now, however, there may be cuts through to the stop of the season, which could trigger a reduction in cost certainly one of loan providers across the country plus in the state of Arizona. Yet not, new Federal Relationship from Real estate professionals expects pricing to remain anywhere between six% and you can 7% through the 2024.