Ideas to Go after Before you take a home loan Online

To get property is amongst the greatest behavior in the anybody’s lifetime and you can good money also. Stepping into a unique domestic and you will keeping everything you finest is actually a beneficial fantasy for almost all. However, buying an aspiration household shouldn’t be an economic headache to you. Well, inside scenario, a mortgage online is a great sorts of financial assistance while quick into bucks or otherwise not on spirits out-of finishing your deals.

Whether you’re waiting for to get another household, the fresh new lending business now offers of many financing options that will be worthwhile and you will helpful. Throughout the years, tech changed several things on the credit globe. Towards quick and easy loan recognition process, it gets simpler buying a property that you choose. Everything you need to see is your real requirements and you will good piece of knowledge about the loan process to construct your own dream home. When you’re fresh to which money world, this is what you must know before-going ahead towards the home loan procedure that will make your experience difficulty-free!

Browse the Possessions Place

Anyone wishes to get a house on the most useful place, on the ideal landscape and services to be able to phone call a place your own. Very before you progress towards the mortgage process or undertake a home, make sure to browse the set two times as its a good one-day money. Our house considering is in the safer locality with all of the first business for example healthcare, industry, university, college or university, workplace things are nearby. This makes everything much easier and challenge-totally free.

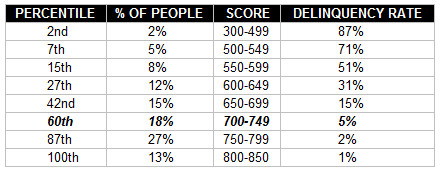

Time for you Look at the Credit rating

Before you apply to own a casing mortgage, it is highly essential to check your credit history since it takes on a vital role during the approving your loan software. Having a good credit score such as for example 750 or maybe more will assist you have made a lower desire mortgage. But when you don’t have good rating, you can however increase it and implement for a financial loan. Instance settling their debts, EMIs, and you may credit card debt timely will help you to in improving the score.

Examine Before applying

When you start making an application for home financing on line, do not just settle for the initial lender you apply to. Do best search to check out numerous lenders, contrast their mortgage has actually and you may rates of interest, and depending on your own comfort, choose that.

Think about the Interest levels

Once you make an application for a mortgage on the web, the speed try a primary issue to look for. Various other lenders give repaired and floating rates. Inside floating cost, rates of interest is automatically modified as per field conditions and you can fixed cost do not changes. The interest prices to own mortgage brokers may vary of financial so you can lender otherwise loans in Lisman out of lender so you’re able to standard bank, very be careful concerning the price and you may repayment period, after which incorporate.

Make certain Concerning your Monetary Cravings

Your ount off mortgage than you prefer however, no reason to take it. Before you apply, make sure to can be pay back the amount punctually without any trouble since you have to make an advance payment also. So it’s crucial that you know how much you want, tenure period, and you can EMIs just before moving on. As well as while you are applying for a mortgage online, look at the adopting the fees too running costs, assets fees, legal or any other fees.

Listing for Obtaining a house Loan

- How old you are might be anywhere between 21 so you’re able to 65 ages

- Will likely be salaried otherwise self-functioning

- The newest candidate will be an Indian citizen

- Try to create a beneficial co-candidate which can make your mortgage recognition easier while you are to ensure lower interest levels

Getting a mortgage has started to become Simple which have Friend Financing

Planning to move into a new family? However, no good economic hands to help you out. No reason to panic given that Buddy Mortgage, one of the better mortgage aggregators will be here so you can score financing effortlessly and you can effectively. Regarding 1000 to 15 Lakhs, you can get a loan according to your circumstances having an effective all the way down rate of interest doing during the % p.an excellent. Additionally you get a flexible cost months one selections off step 3 months to five years. So expect you’ll buy your fantasy domestic today.

Step-by-step Advice getting Implementing Loan

- Before deciding to your loan provider, you should evaluate and examine the loan demands, eligibility criteria, credit score, or any other points.

- Look at the rate of interest, repayment processes, and you may loan period that may make your mortgage operating sense finest.

- Once you try for an educated financial, it’s time to fill up the mortgage application and you can complete it. Today the procedure is extremely simple and smooth as you can do so online and means limited records.

- Shortly after distribution the mandatory mortgage data files or any other one thing, the loan provider have a tendency to make certain everything you, conclude the borrowed funds count, and you can telephone call one bring more information.

- And latest action is disbursal. The new approved matter was credited for you personally and also you is follow the preparations of purchasing a property.

Availing to have a home loan is simple nowadays. Fulfilling all standards and having all the records makes the loan acceptance processes convenient. As to the reasons wait? Get that loan online today and now have your dream domestic now!

Download Consumer loan App

Trying to find a fast financing? Pal Loan makes it possible to get a quick mortgage about ideal RBI-accepted loan providers. Download brand new Pal Financing Application about Enjoy Shop or App Shop thereby applying for a financial loan today!