First-Big date Homebuyer Software and you can Provides within the Sioux Falls, South Dakota

On the other hand, FHA loans accommodate high financial obligation-to-money ratios, which makes it easier having customers with figuratively speaking and other debts so you’re able to be considered

Purchasing your basic house is a critical milestone, full of adventure and you can a feeling of achievement. not, the procedure normally challenging, especially when considering investment. To have very first-time homebuyers inside the Sioux Drops, Southern area Dakota, knowing the readily available financial help programs and you will has produces this new travels convenient and more sensible. Contained in this full guide, we shall mention individuals basic-big date homebuyer programs, offers, and you will information that can help you reach your imagine homeownership during the Sioux Drops.

Prior to delving on information on financial assistance, it’s really worth noting why Sioux Drops is a great option for first-time homebuyers. Recognized for the brilliant area, robust discount, and you can reasonable price out of life style, Sioux Drops now offers a superior quality out-of lifetime. The town is sold with higher level universities, a diverse job market, and various leisure potential, making it an attractive place to calm down.

First-day homebuyer applications are made to let anyone who has never had a house otherwise haven’t had a property from the earlier in the day 36 months. Listed below are some secret programs open to very first-go out homebuyers inside Sioux Falls:

- South Dakota Casing Innovation Power (SDHDA) Software

- First-Big date Homebuyer Program: This option brings competitive interest rates minimizing mortgage insurance costs. To qualify, people need certainly to satisfy money and buy rates limits and you will over a homebuyer education direction.

- Fixed Price Together with Loan: Also the great things about the first-Go out Homebuyer System, the https://paydayloanalabama.com/providence/ fresh Fixed Rate Along with Mortgage also offers a good 3% down payment advice offer which you can use to the brand new down percentage and you may settlement costs.

- Governor’s Domestic Program: Which initiative assists money-accredited customers pick a reasonable, energy-productive home-built of the inmates as an element of its rehabilitation system. The fresh new home are available in the a reduced price, causing them to just the thing for basic-day buyers on a tight budget.

- Government Construction Administration (FHA) Financing

FHA funds was well-known certainly one of very first-day homebuyers employing low down commission standards and versatile credit history standards. Which have a keen FHA financing, people can also be put down as low as step three.5% of the purchase price.

- U.S. Service away from Farming (USDA) Funds

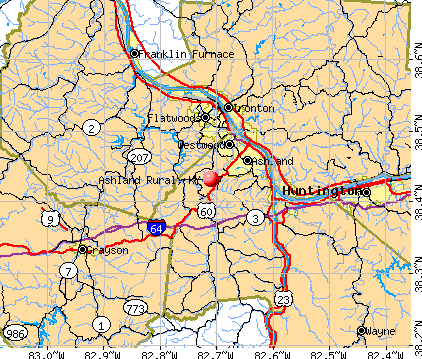

For those given homes from inside the rural areas around Sioux Drops, USDA funds promote a zero down payment solution. These types of finance are made to give homeownership during the rural and residential district elements and you can have competitive interest rates and you can lowest mortgage insurance coverage will set you back. So you can be considered, people must see money qualification conditions and purchase property into the a designated USDA outlying area.

- Veterans Points (VA) Loans

These apps tend to promote financial assistance when it comes to offers, loans, or tax loans to minimize the financial load of purchasing a good house

Virtual assistant finance are available to eligible veterans, active-duty provider participants, and you can specific people in the fresh National Guard and Reserves. Such loans render several benefits, as well as no downpayment, zero private financial insurance rates (PMI), and aggressive interest levels. Virtual assistant funds have alot more lenient borrowing standards, making them accessible to of a lot very first-go out people.

- HomeReady and you can Family You can easily Finance

Fannie Mae’s HomeReady and you can Freddie Mac’s Family You’ll apps are built to assist reasonable-to-moderate-money individuals. These software offer low-down percentage choice (only step three%) and versatile underwriting conditions. On the other hand, each other programs bring quicker financial insurance standards, which can straight down monthly premiums.

Plus fund, numerous provides and advice applications are around for first-go out homeowners in the Sioux Drops. These types of software bring financing which do not have to be reduced, reducing the initial costs associated with to shop for property.