As to the reasons Have fun with a good USDA Rural Innovation Financing?

You happen to be shocked to learn that Virtual assistant money are not brand new just mortgage apps online that do not wanted a down payment.

If you are 100%-funded Virtual assistant funds are only accessible to Veterans and their qualified partners you will find another well-known zero-money-off loan which is available to the certified consumers.

Its an application which is put regularly to possess domestic purchase investment and refinancing within the residential district and you will outlying components within the U.S. as well as inside our pa.

It’s the You.S. Institution from Farming (USDA) Outlying Development Mortgage system and it’s probably one of the most useful home loan apps you could potentially qualify for if you’re inside the a qualified venue.

Continue reading to understand the many benefits of rural creativity fund and you may score most tips so you can know if such mortgage suits you.

Other than giving a hundred% resource so you New Hartford Center loans can accredited individuals, there is certainly an excellent flurry from even more advantages to using an RD loan, including:

- All the way down rates than old-fashioned home loan pricing

- Settlement costs could be rolling to your loan

- Down month-to-month Financial Insurance premiums

How will you See a home is approved to possess a good USDA RD Loan?

Hooking up together with your Gulf of mexico Coastline Financial Lenders loan administrator are step one to take if you find yourself selecting studying even in the event a rural creativity financing is actually a choice for you. The loan officer can help you determine your own eligibility and possess you pre-competent to purchase a house.

The next step is making sure a house you are interested within the to purchase is situated in an eligible urban area. You need to use the brand new USDA’s property qualifications product to do this by entering the target(es) of any characteristics you’re interested in buying.

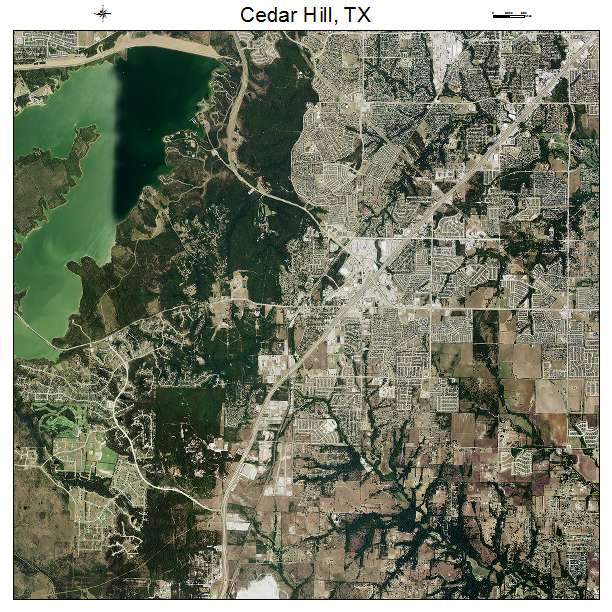

It is better to consider that USDA’s definition of rural is a broad you to. It’s identified as one town that have a populace out-of below 35,100000 some body. This commercially mode 97% of your You.S. could possibly get be considered.

During the City The fresh new Orleans, this includes portion to your Western Bank, on the Northshore, plus in Tangipahoa Parish. Outside Rod Rouge, qualities from inside the Denham Springs and you will as much as Livingston Parish may qualify. So there are certain components beyond Austin, Destin, plus the Tampa suburbs that be considered.

Even more Eligibility Standards to possess USDA Loans

- Possessions is employed because the an initial household

- Money attributes and next residential property aren’t eligible

- Property can’t be a living-promoting ranch

- There must be entry to the home from a road, roadway, otherwise driveway

- There must be sufficient resources, water, and you will a good wastewater fingertips program repair the house

- New house’s foundation need to be structurally sound

Regarding borrower earnings, your revenue dont go beyond brand new limit place by the USDA. Which limit depends on the region of the house and you can how many individuals who often reside in your house. You ought to have a personal debt-to-money ratio that fits USDA criteria.

The brand new USDA enjoys a full time income eligibility product which is useful in deciding should your money qualifies. You need to including reach out to financing administrator so you can explore your debts and you can qualification in detail.

Why don’t we Mention If or not Outlying Advancement Finance Could be a choice for You!

The most best ways to dictate your revenue and you can possessions qualification to own a great USDA rural invention mortgage will be to apply to good mortgage administrator near you. Our very own mortgage officials was right here so you’re able to come across better-complement lenders for your financial demands.

Warning: Youre Making The site.

You are going to go after a relationship to [Link] . To help you go ahead, mouse click ‘continue’ lower than. To keep on this web site, mouse click ‘cancel’ lower than.