Almost every other Financial Functions and you can Finance Supplied by Experts United

Veterans Joined Prices and Costs

Veterans Joined shares the current Virtual assistant loan rates of interest on the site. According to the most recent investigation, Experts United’s rates try quite lower than otherwise into the par to your national mediocre for both 30-season and 15-season repaired-rate Va money.

Unfortunately, Experts United doesn’t divulge its rates to have low-Virtual assistant financing, making it difficult to give how they accumulate on battle. That being said, a good lender’s average cost commonly always reflective of your own speed you’ll be able to be offered. Discover a personalized rate estimate when it comes down to version of mortgage out of Veterans Joined, as well as a Va loan, you will need to look at the pre-acceptance techniques and you can say yes to a hard borrowing from the bank query.

Bringing multiple rates is very important when searching for a home loan. In reality, centered on a study of the Freddie Mac, consumers which seek at the very least four estimates features the typical annual deals regarding $1,two hundred. A separate research from the Federal Set aside Financial of Philadelphia found that seeking a minumum of one most rates estimate leads to a keen 18-basis-area rates prevention and a 28-part protection to possess lower-money individuals.

Together with the loan rate of interest, additionally, you will spend particular loan charge. Experts United charges an apartment step one% origination fee for the the fund, that’s to your high-end from normal for most lenders. When you are taking out a great Va loan, you’ll also have to pay a beneficial Virtual assistant funding commission, but that’s recharged by Va as opposed to Veterans United and you may often implement regardless of the lender you use off.

On the internet Feel

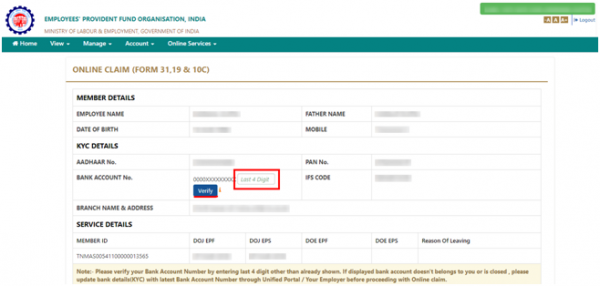

Veterans United’s web site is fairly easy to browse. The brand new pre-approval procedure is simple and you may care about-explanatory. You can select tips including educational articles, financial calculators, this new homebuying path, borrowing consulting guidance, Va financing cost, and a lot more.

The place you can get struggle with Experts United’s webpages is when you may be obtaining financing except that an excellent Virtual assistant loan. When you’re Pros Joined offers traditional financing, FHA loans, and you can USDA fund, it will not generate information about men and women funds free to your their website, nor will it divulge interest levels for the those individuals fund.

Customer service

One of the places where Experts Joined really stands out was in customer support. It’s got 24/7 support service to suit their overseas consumers-this can be especially important offered its manage Virtual assistant finance. You can contact the company via phone, email, post, otherwise one of the various social networking profiles.

Client satisfaction

Experts United has truly a fantastic client satisfaction score. Earliest, the lending company gets the highest-ranking of every financial in J.D. Power’s 2023 U.S. Financial Origination Pleasure Research. What’s more, it keeps an average score of cuatro.9 from 5 stars toward Trustpilot. It offers more than 11,000 evaluations and you can 96% ones was 5-celebrity recommendations.

Of several product reviews praise their expert support service in addition to convenience of your own homebuying processes. Although not, its worthy of listing that every of them critiques specifically reference Virtual assistant loans-it’s difficult locate recommendations off people who have obtained other financing products away from Experts Joined.

Account Management

After you personal towards the a mortgage, lenders could possibly get promote the borrowed funds to another loan servicer. Pros Joined doesn’t divulge when it transfers or carries their fund to a different servicer.

If Pros United keeps your property mortgage, you could potentially do they out of your on the web membership otherwise cellular application. Truth be told there, possible track and you may control your money, and additionally installing vehicles-pay.

Pros United isn’t really an entire-solution standard bank, meaning it doesn’t bring financial and other similar monetary qualities. But not, the company has one or two other related americash loans Hoehne characteristics.

Very first, Veterans Joined Realty was a joint venture partner mate of your bank. It’s a nationwide community of real estate agents throughout the U.S. you to specialize in providing pros purchase land. Borrowers who explore each other Veterans United Realty and you will Veterans Joined Household Funds is qualified to receive particular deals on the settlement costs or rate of interest.