All of these parts also need to provides a serious use up all your off financial borrowing from the bank supply having moderate minimizing-money family

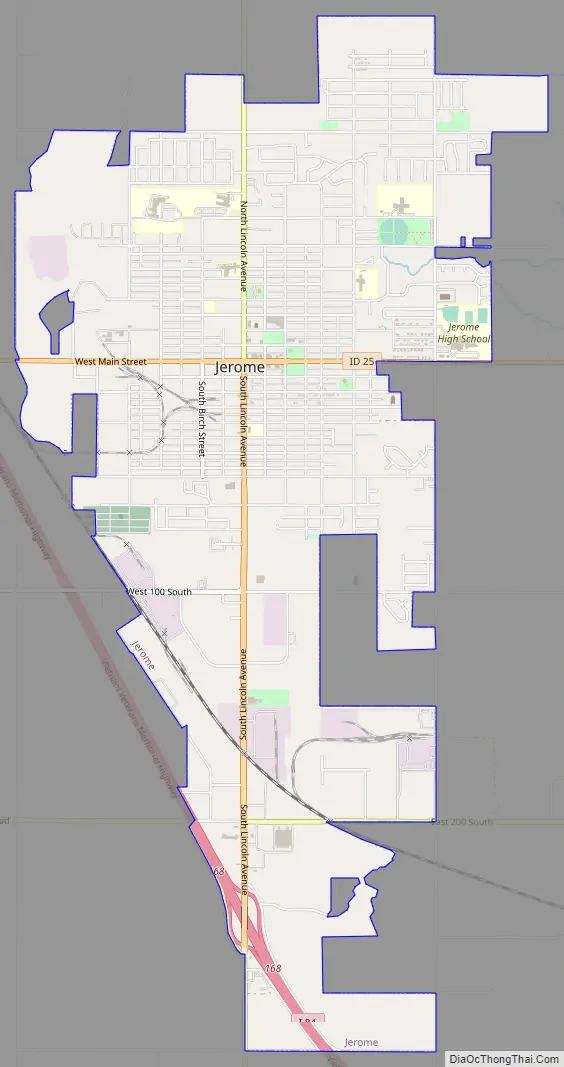

USDA Mortgage Minimum Property Criteria

Should you want to buy a house but do not has actually the money to own a down payment, the fresh new USDA financing system may be the answer.

Should you decide to shop for property in the a rural city, you might be eligible for brand new USDA program. Your children earnings must not meet or exceed 115% of your own median in the area on the best way to qualify, so there are restrictions into the house which can be bought using this type of mortgage.

Before you make an application for these mortgage, you should know the property standards try to see to qualify. This type of USDA minimum possessions standards make sure the house is structurally safe, for the a good fix, and you will functionally sound.

These types of standards might appear to be extremely tight, but they do include the customer, together with make sure the USDA is not promising financing that’s too large a threat.

Assets Location Eligibility

Good USDA mortgage are only able to be used to purchase property that is an initial household discover within this a place designated since outlying of the all of them. Usually, outlying areas are believed is open country that is not part of a city. This may imply any area if you don’t urban area in case it is not for the a city.

The neighborhood could even be next to a heavily inhabited city, for as long as its rural from inside the profile in addition to population try less than ten,000. Even portion you to share a line can be considered on their own to own rural group whenever their main compensated areas aren’t really 2nd to one another.

- 189 Shares

-

- It can’t be in a place categorized because an urban analytical city (MSA) but could has a populace anywhere between ten,000 and you may 20,000.

- A location categorized in the past as the rural just before Oct 1, 1990, who’s as started calculated never to feel outlying out of census study.

- Anywhere categorized as the an excellent outlying city ranging from , with an inhabitants ranging from 10,000 and you will thirty five,000 from the 2020 census.

Section that will be entitled to USDA funds can transform a year. Altering populace systems and other points affect the eligibility off an enthusiastic urban area.

The guidelines in the USDA do support elements you could potentially not really expect to-fall within standards. However, to be sure if the area you are looking to acquire a house during the is approved, you can check the actual address otherwise standard city toward USDA webpages.

USDA Family Criteria

The home we want to purchase have to fulfill certain requirements. The brand new USDA features these types of standards so that the debtor are secure, and you may, if the household foreclose, their welfare as well.

Residential property one qualify for the newest USDA program need to be what it envision more compact. This means that they should not have an industry well worth over the room financing maximum, that is usually 80% of your local HUD 203(b) restriction.

How big the home must generally end up being anywhere between 400 and you will 2000 sq ft. Belongings with smaller rectangular video footage, otherwise smaller belongings, would be approved if they meet with the most other conditions, although not.

- Small on the area

- The fresh debtor has another type of significance of more room

- Possession prices are not probably going to be a lot of

Our home must also have been developed for permanent living, having at the least a room, kitchen area, living area, and you can toilet. Yet not, it can’t features an in-ground swimming pool, no matter if it is wanted to be removed.

Services cannot is property otherwise home made use of generally to generate income. It indicates farm property eg barns, commercial greenhouses, and you may silos unless of course he is not used for its completely new goal. Yet not, this won’t limit family-situated enterprises as long as they avoid the use of industrial property.