Advantages of Using an immediate Lender within-Home Mortgage Processing and you can Underwriting versus home financing

Talk to any loan manager, and they’re going to tell you that it is far from easy to close an excellent financial. But a professional financing administrator make the method appear smooth towards the debtor. When you purchase a property, you need a beneficial mortgage officer who works for suitable providers to give you through the techniques instead a lot of hiccups.

A factor that takes on a major part in the advances regarding their mortgage ‘s the types of organization you utilize. It will make a significant difference if you use a mortgage brokerage otherwise a direct lender.

What’s a mortgage broker?

A mortgage broker is a family that starts finance getting members and you may leaves them in addition to a bank that can give the brand new debtor the money they must get their property. Just after a large financial company looks through the buyer’s data and you can gains an insight into the financing circumstances, they just be sure to determine which lender was most appropriate getting that one consumer.

Most of the financial keeps slightly additional criteria, thus choosing which to choose relies upon the fresh new borrower’s state. An excellent large financial company you will sign up for do funds having those banking institutions, but will have a small few “go-to” lenders. Some of the facts that can help the borrowed funds representative dictate which financial to choose is:

- How much money the latest borrower provides getting a down payment

- Brand new customer’s credit history

- When your buyer try thinking-operating otherwise an employee

- A career records

- The fresh new borrower’s ability to create papers

Financing Processing

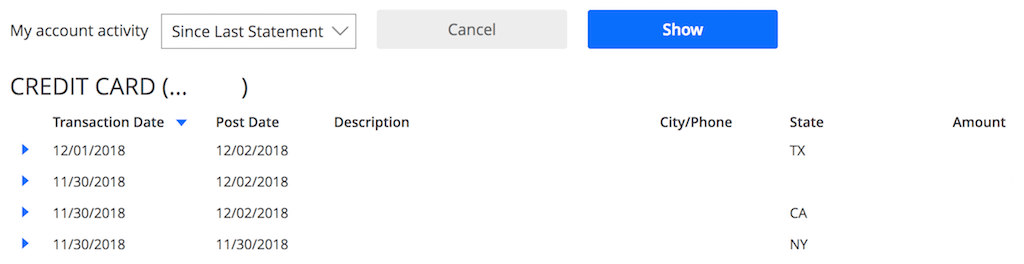

When you complete a home loan app, your loan administrator needs to assemble papers to ensure your information. Then they violation the information about to a processor chip while making sure that everything stated on the software is specific. If something try forgotten or inaccurate, they’re going to possibly get financing officer extend otherwise they will-call your by themselves.

Financing Underwriting Techniques

When your documents is within acquisition, the brand new processor tend to hand your own file out to an enthusiastic underwriter just who tend to check if your qualify for the mortgage centered on the of your guidance you considering. New underwriter is the individual that signs off the financing and you will gives the lender the newest okay to lend your currency.

Most finance enjoys lots of about-the-moments backwards and forwards between your mortgage manager, chip, and you will underwriter. Its very important to own correspondence to circulate efficiently ranging from these events for a loan to close in place of unnecessary hiccups.

Which are the Benefits of Playing with an immediate Financial?

step 1. When you use a large financial company, the agent and bank have to make currency. That with an immediate lender, you’re generally eliminating the fresh new middleman, which will means there’ll be fewer costs associated with their financial.

dos. Direct loan providers have significantly more autonomy than payday loan Shiloh mortgage brokers. Eg, some financial institutions has set regulations and require a couple of years from tax returns for each notice-functioning borrower. A lender can often play with discretion whenever a borrower possess compensating factors-like good credit or reserve money-and you will agree the mortgage with you to definitely income tax go back.

step three. Mortgage officers has actually immediate access so you’re able to processors and underwriters and can clarify activities who does if you don’t get a loan nixed. They also have sensible away from exactly what their organization is happy to neglect or wade simple for the and what they won’t help slip, to enable them to share with right away in the event the the organization is attending agree the loan.

First Savings Home loan try a primary lender. We manage every aspect of your home loan in the-house to be certain because simple a process that you can. When you’re on the market to purchase a house otherwise refinance your existing domestic, get in touch with one of the masters to get the recommendations and you can service your need.