Among the many investment techniques we come across implemented are securitized tools, as well as CLOs, and you may business borrowing from the bank

Regulating treatment

FHLBanks dont maximum how its professionals have fun with improves. not, insurance agencies must take into account exactly how evaluations firms evaluate give-improvement points, exactly how these programs connect with RBC, as well as how county statutes eters. Advances, together with those people pulled for bequeath enhancement, are classified as possibly money arrangements, which can be largely certain to life insurance firms, otherwise personal debt. Funding plans (deposit-sorts of deals awarded because the general membership personal debt) are usually addressed since the functioning leverage. To have non-existence enterprises, improves carried while the obligations can also qualify since the performing influence in the event the they meet the requirements off private product reviews businesses.

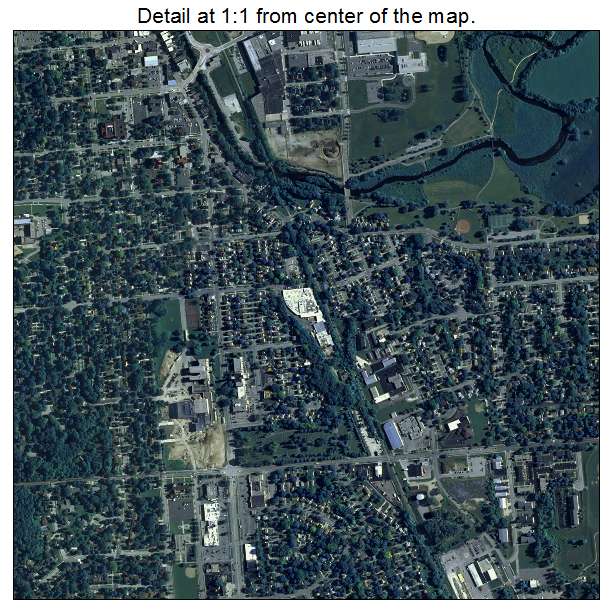

RBC effect having FHLB pass on lending apps differ by the providers line, measurements of get better, posted equity, and you can investment allowance. Profile 6 summarizes potential RBC fees and if the newest pass on profile try invested having at least top-notch NAIC 2 and you will a secured asset mixture of fifty% NAIC step one ties and you can fifty% NAIC 2 bonds. Coverage firms that design a spread credit improve in this a great financial support contract, because the depicted, make use of an effective 2018 inform to your RBC design: Capital charges try analyzed just on the portion of guarantee a lot more than and you may outside the progress amount. Of course an upfront folks$100 mil and you will a guarantee container researching good ten% haircut, a lifestyle insurance carrier would have to blog post All of us$110 million in total guarantee. The us$100 million equity number comparable to the improvement does not generate a capital costs; rather, just the You$10 mil more than-collateralization drops to your range having a keen RBC charges.

If you find yourself insurers hardly make up more 6% out of overall FHLB affiliate borrowers, over the years he has got had a large share from face value enhances because their borrowings become larger than those of most other member types. It is worthy of listing one to insurers’ change from 18% regarding face value away from enhances stored in the 2019 to help you 34% from overall advances stored into the 2021 lead regarding the mix of a boost in credit from the insurance vendors and a great 16% lose for the improves stored by industrial banking institutions seasons more than year; just like the converse is actually genuine from the springtime of 2023, insurance carrier share regarding advances has expanded on 2024, spanning 19% at the time of the original one-fourth. The costs to an enthusiastic FHLBank of making a loan vary nothing by loan proportions since in earlier times detailed, very providing huge improves may help insurance vendors see relatively good mortgage terms.

Getting funds to work

Just how is insurance providers with regards to increased FHLB borrowings? Unsurprisingly, in the overall economy and COVID pandemic, insurers’ exchangeability requires drove an increase within the improves. Exchangeability remains a prominent desire today, having an array of uses: to pay for good merger otherwise order, fulfill regulating criteria, and you can serve as an operating-investment backstop. Insurance agencies additionally use FHLB money to handle and you will mitigate focus-rates and other threats, optimize risk-built resource (RBC), treat bucks drag, fulfill social specifications, complement ALM years, and you will arbitrage equity. Instance, insurers get borrow cash to protect reinvestment pricing and you can offer the size of current financing portfolios, or to fill liability maturity openings and you may tighten ALM stage.

An opportunity for pass on improvement

We believe insurers will find make the most of FHLB borrowings within the produce arbitrage, where there was potential to secure excessive spread-over the cost off a keen FHLB get better. Portfolios planned having a goal from bequeath enhancement along side lower rate away from an enthusiastic FHLB improve can offer solutions for insurance agencies in order loans in Victor to put alpha otherwise give. (CLOs and you can brief borrowing have even so much more focus when you look at the an appearing-price environment.) Additionally, FHLBanks shall be versatile inside the structuring money, offering a selection of solutions as well as name and you can rate alternatives, and additionally fixed- otherwise floating-speed prices, prepayment, and you may planned alternatives.